Welcome to MiCA Ready

|

MiCAReady.com is a portal of information on getting your business ready for its MiCA authorisation and thereafter staying compliant to remain authorised. We also provide Independent Non-Executive Directors (INED) services to Virtual Asset Services Providers, Crypto Asset Services Providers, Emoney & Payments Institutions and MiFID firms.

In partnership with MiCAEU.com |

The European Commission presented the legislative proposal for MiCAR on 24 September 2020 as part of the Digital Finance Package for digitally transforming the financial sector. In addition to the proposal for MiCAR, the package comprises of a legal act on digital operational resilience in the financial sector (DORA; Digital Operational Resilience Act), a proposal for a pilot regime (oft referred to as the “DLT Pilot”) for market infrastructures based on distributed ledger technology (DLT) as well as strategy for a digital financial industry.

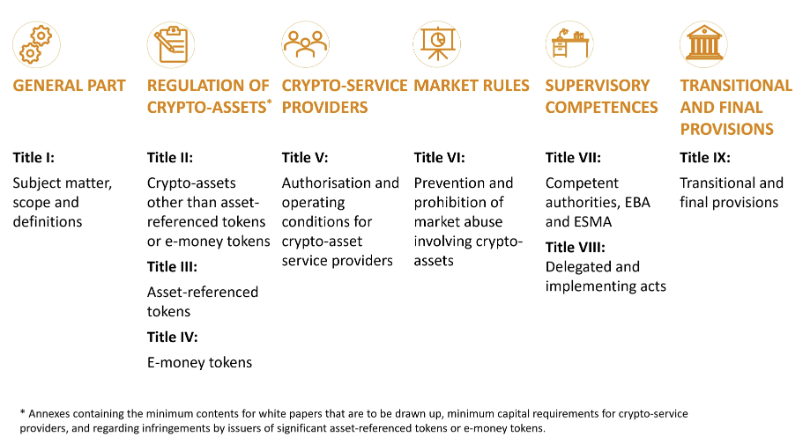

The Four Key Parts of MiCAR

|

Authorisation

Presently a business cannot apply for authorisation under MiCA for EU passportable services. At the present time your only option is registration with a EU Member State. However if you desire whole of EU coverage you will need to register as a VASP in each Member State. If you require a registration in a Member State please contact CompliReg a leading regulatory authorisation and registration professional service company headed by Peter Oakes. Peter is one of the INEDs we work with. Rules & Regulations

On 16 May 2023 the European Council adopted a regulation on markets in crypto-assets (MiCA). |

Getting Ready

There are no twos way about it. To get MicA Ready you need to read the the draft regulations. See this post by Fintech Ireland where it has provided links to the final wording of the regulations as at 16 May 2023. You might also visit Fintech Ireland's Crypto page where you will find relevant and up-to-date information. Also follow Peter Oakes on Linkedin for his posts on crypto. MiFID & MiCA

On 25 May 2023 ESMA highlighted the risks arising from the provision of unregulated products and/or services by investment firms (ESMA35-36-2813). The ESMA and National Competent Authorities specifically stated that "while the Markets in Crypto-Assets Regulation (MiCA) is close to adoption, crypto assets offered by investment firms will continue to be unregulated in most jurisdictions until MiCA applies." ESMA also set out examples of behaviours it expects to see when investment firms are provide unregulated products/and or services to investors, such as crypto. |

I am very pleased that today we are delivering on our promise to start regulating the crypto-assets sector. Recent events have confirmed the urgent need for imposing rules which will better protect Europeans who have invested in these assets, and prevent the misuse of crypto industry for the purposes of money laundering and financing of terrorism.

Elisabeth Svantesson, Minister for Finance of Sweden.