Important MiCA developments

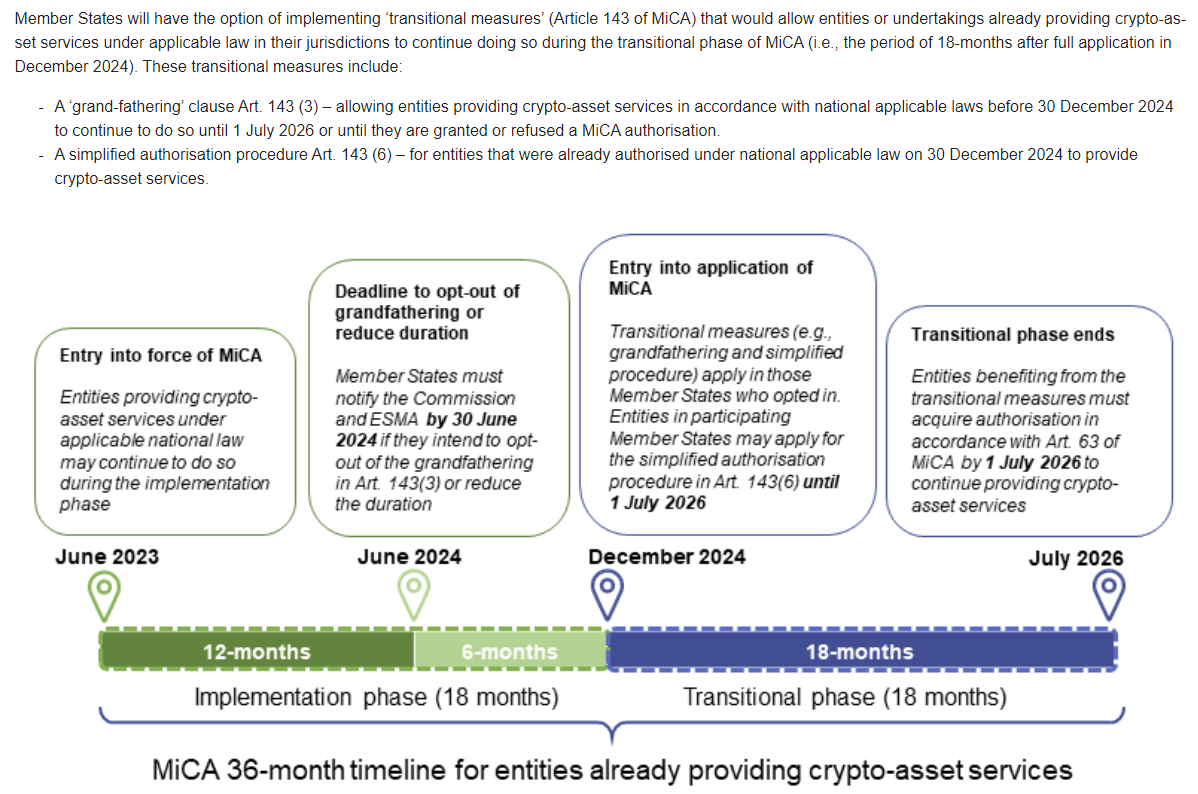

MiCA 36 month timeline for entities already providing crypto-asset services

29 January 2024: Consultation paper on guidelines on (1) reverse solicitation and (2) financial instruments from the European Securities and Markets Authority (ESMA).

ESMA, the EU’s financial markets regulator and supervisor, has published two Consultations Papers on guidelines under MiCA:

1) one on reverse solicitation, and

2) one on the classification of cryptoassets as financial instruments.

Reverse solicitation and separately the definition of 'financial instrument' are crucial, especially with respect to

the former as many crypto firms (and lawyers) struggle to understand what reverse solicitation is all about under Markets in Crypto Assets Regulation (MiCAR). Whereas the latter is important for bridging the MiCAR and the Markets in Financial Instruments Directive II (MiFID II) and ensuring consistency across the EU.

Further, on the reverse solicitation point, the proposed guidance confirms ESMA’s previous message that the provision of crypto-asset services by a third-country firm is limited under MiCA to cases where the client is the exclusive initiator of the service. This exemption should be understood as very narrowly framed and must be regarded as the exception. A firm cannot use it to bypass MiCA.

In addition, the proposed guidelines aim at providing NCAs and market participants with structured but flexible conditions and criteria to determine whether a crypto-asset can be classified as a financial instrument. Therefore ESMA is seeking input on establishing clear conditions and criteria for the qualification of crypto-assets as financial instruments. This initiative, which follow on from previous work by ESMA.

Comments due by 29 April 2024.

#MiCAReady

ESMA, the EU’s financial markets regulator and supervisor, has published two Consultations Papers on guidelines under MiCA:

1) one on reverse solicitation, and

2) one on the classification of cryptoassets as financial instruments.

Reverse solicitation and separately the definition of 'financial instrument' are crucial, especially with respect to

the former as many crypto firms (and lawyers) struggle to understand what reverse solicitation is all about under Markets in Crypto Assets Regulation (MiCAR). Whereas the latter is important for bridging the MiCAR and the Markets in Financial Instruments Directive II (MiFID II) and ensuring consistency across the EU.

Further, on the reverse solicitation point, the proposed guidance confirms ESMA’s previous message that the provision of crypto-asset services by a third-country firm is limited under MiCA to cases where the client is the exclusive initiator of the service. This exemption should be understood as very narrowly framed and must be regarded as the exception. A firm cannot use it to bypass MiCA.

In addition, the proposed guidelines aim at providing NCAs and market participants with structured but flexible conditions and criteria to determine whether a crypto-asset can be classified as a financial instrument. Therefore ESMA is seeking input on establishing clear conditions and criteria for the qualification of crypto-assets as financial instruments. This initiative, which follow on from previous work by ESMA.

Comments due by 29 April 2024.

#MiCAReady

5 October 2023: ESMA Consultation Paper Technical Standards specifying certain requirements of Markets in Crypto Assets Regulation (MiCA) - second consultation paper 2nd Package (ESMA75-453128700-438).

ESMA will consider all comments received by 14 December 2023.

This consultation paper contains six sections (chapters 3 – 8) relating to (i) the content, methodologies and presentation of sustainability indicators and adverse impacts on climate; (ii) continuity and regularity in the performance of CASP services; (iii) offering pre- and posttrade data to the public; (iv) content and format of order book records and record keeping by CASPs; (v) machine readability of white papers and the register of white papers; and (vi) the technical means for appropriate public disclosure of inside information.

ESMA will consider all comments received by 14 December 2023.

This consultation paper contains six sections (chapters 3 – 8) relating to (i) the content, methodologies and presentation of sustainability indicators and adverse impacts on climate; (ii) continuity and regularity in the performance of CASP services; (iii) offering pre- and posttrade data to the public; (iv) content and format of order book records and record keeping by CASPs; (v) machine readability of white papers and the register of white papers; and (vi) the technical means for appropriate public disclosure of inside information.

12 July 2023 - EBA:

EBA consults on draft technical standards on EU market access of issuers of asset-referenced tokens under the Markets in Crypto-Assets Regulation.

12 July 2023 - ESMA:

Consultation Paper Technical Standards specifying certain requirements of the Markets in Crypto Assets Regulation (MiCA) 1st Package (ESMA74-449133380-425)

ESMA will consider all comments received by 20 September 2023.

This consultation paper contains seven sections (chapters 2 – 8) relating to the content, forms and templates for notification by certain financial entities, content, forms and templates for the application for authorisation of Crypto Assets Service Providers (CASPs), the complaint-handling procedure, the identification, prevention, management and disclosure of conflicts of interest by CASPs and the assessment of intended acquisition of qualifying holdings requirements.

EBA consults on draft technical standards on EU market access of issuers of asset-referenced tokens under the Markets in Crypto-Assets Regulation.

- Deadline for the submission of comments is 12 October 2023.

- EBA will hold a virtual public hearing on the consultation paper on 21 September 2023 from 11:30 to 13:30 CEST.

- All contributions received will be published following the end of the consultation, unless requested otherwise.

- The scope of the consultation, and of the consultation questions, is limited to the amendments and additions.

- READ MORE HERE

- Read the EBA statement "The EBA encourages timely preparatory steps towards the application of MiCAR to asset-referenced and e-money tokens"

12 July 2023 - ESMA:

Consultation Paper Technical Standards specifying certain requirements of the Markets in Crypto Assets Regulation (MiCA) 1st Package (ESMA74-449133380-425)

ESMA will consider all comments received by 20 September 2023.

This consultation paper contains seven sections (chapters 2 – 8) relating to the content, forms and templates for notification by certain financial entities, content, forms and templates for the application for authorisation of Crypto Assets Service Providers (CASPs), the complaint-handling procedure, the identification, prevention, management and disclosure of conflicts of interest by CASPs and the assessment of intended acquisition of qualifying holdings requirements.

09 June 2023: Publication of the MiCA Regulations ((EU) 2023/1113) and Transfers of Funds (and Crypto Asset) Regulations ((EU) 2023/1114). L150, Volume 66:

★ Regulation (EU) 2023/1113 of the European Parliament and of the Council of 31 May 2023 on information accompanying transfers of funds and certain crypto-assets and amending Directive (EU) 2015/849. CLICK HERE

★ Regulation (EU) 2023/1114 of the European Parliament and of the Council of 31 May 2023 on markets in crypto-assets, and amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EU and (EU) 2019/1937 CLICK HERE

★ Regulation (EU) 2023/1113 of the European Parliament and of the Council of 31 May 2023 on information accompanying transfers of funds and certain crypto-assets and amending Directive (EU) 2015/849. CLICK HERE

★ Regulation (EU) 2023/1114 of the European Parliament and of the Council of 31 May 2023 on markets in crypto-assets, and amending Regulations (EU) No 1093/2010 and (EU) No 1095/2010 and Directives 2013/36/EU and (EU) 2019/1937 CLICK HERE

Note: The Regulations enter into force 20 days after publication (i.e. 20 days after Friday 9 June 2023). The publication of the rules in the journal means that MiCA provisions apply from Monday 30 December 2024, however parts of the law will take effect on Sunday 30 June 2024.

Linkedin Post HERE

Linkedin Post HERE

31 May 2023: European Union formally signs Markets in Crypto Assets (MiCA) regulation into law on Wednesday 31 May 2023.

31 May 2023: EBA consults on amendments to the Guidelines on money laundering and terrorist financing risk factors to include crypto-asset service providers. The proposed changes extend the scope of these Guidelines to crypto-asset service providers (CASPs). The consultation runs until 31 August 2023.

25 May 2023: ESMA highlighted the risks arising from the provision of unregulated products and/or services by investment firms (ESMA35-36-2813).

16 May 2023: 2021/0241(COD) Information accompanying transfers of funds and certain crypto-assets (see 20 April 2023 for European Parliament legislative resolution of 20 April 2023 on the proposal for a regulation of the European Parliament and of the Council on information accompanying transfers of funds and certain crypto-assets (recast) (COM(2021)0422 – C9-0341/2021 – 2021/0241(COD))

16 May 2023: European Council adopted a regulation on markets in crypto-assets (MiCA).

30 April 2023: Remaining regulatory challenges in digital finance and crypto-assets after MiCA (European Parliament)

- This study analyses the need to adopt further EU financial regulation on decentralized finance after the implementation of the Markets in Crypto Asset Regulation and the revision of the Transfer of Funds Regulation, with a special view on crypto lending, crypto staking, crypto custody, the use of non-formal information, NFTs and sustainability. This document was provided by the Policy Department for Economic, Scientific and Quality of Life Policies at the request of the Committee on Economic and Monetary Affairs (ECON).